About

The County funds its capital program based on the requirements of the General Plan and supporting master plans for recreation and parks, human services, schools, community college, water and sewer, solid waste, libraries, police and fire stations and public facilities. The County uses an annual debt affordability process to determine reasonable debt levels.

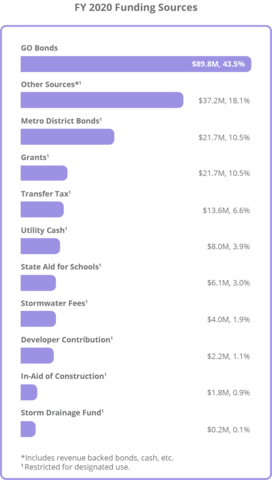

Fiscal Year 2020 Capital Revenues

County’s capacity to fund future capital projects has been decreasing

Past decisions on the level of authorized debt, which utilized not only current but also future revenues to make debt service payments, and a slowdown in total revenue growth in the operating budget in recent years, have rapidly shrunk the capacity to issue new debt to support infrastructure projects.

- County’s capacity to issue new General Obligation (GO) bonds, the primary funding source for capital projects, has dropped by more than 20% from an average of $112.9 million between FY11 to FY19, to $89.8 million in FY20.

- Funding capacity in other designated funding sources such as School Surcharge, Road Excise Tax and Transfer Tax has also been largely exhausted; some of these are not even sufficient to pay existing debt.

- With a shrinking capacity to fund capital projects, the County has to balance the needs for maintaining, renovating and repairing existing infrastructure with those for new capital projects.

- Incurring more than adequate level of debt would not only increase the County’s debt burden or long-term liabilities and risk the County’s AAA credit rating, but also result in less funding available for all other services if debt service payments as a share of annual operating budget keeps growing.

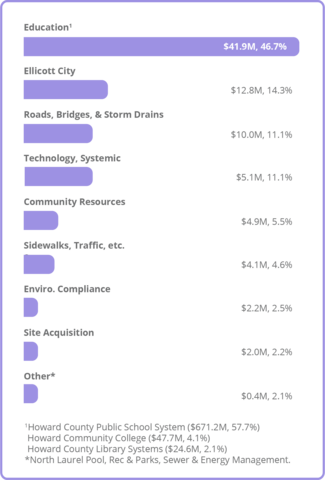

Fiscal Year 2020 Capital Expenditures

Education remains the County’s No. 1 priority

- The County’s primary source to fund capital projects are General Obligation (GO) bonds, which are backed by the full faith and credit of the County.

- Education spending, which primarily goes to public schools, accounts for about 47% of all GO bonds in Fiscal Year 2020.

Long Term Outlook (FY 2020 to FY 2025)

Infrastructure funding requests (GO Bonds) by all entities per the Fiscal Year 2020 capital budget book are significantly above affordable levels.

- County’s capacity to issue new General Obligation (GO) bonds, the primary funding source for capital projects, has dropped by more than 20% from an average of $112.9 million between FY11 to FY19, to $89.8 million in FY20.

- Incurring more than adequate level of debt would not only increase the County’s debt burden or long-term liabilities and risk the County’s AAA credit rating, but also result in less funding available for all other services if debt service payments as a share of annual operating budget keeps growing.

| Go Bonds | FY21 | FY22 | FY23 | FY24 | FY25 |

|---|---|---|---|---|---|

| Funding Request | $242.0M | $295.0M | $187.4M | $227.5M | $108.7M |

| Affordable Level | $90.0M | $90.0M | $90.0M | $90.0M | $90.0M |

| Shortfall | ($152.0M) | ($205.0M) | ($97.4M) | ($137.5M) | ($18.7M) |