The General Fund is the portion of the budget where general tax revenues, such as property and income taxes, are collected, and where general expenditures such as the County’s cost for education, police, snow removal and libraries are made.

FY 2020 General Fund Revenues

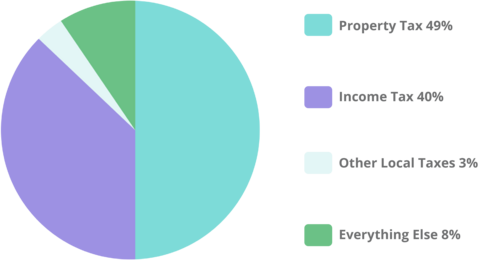

Property and income taxes account for about 90% of total General Fund revenues

- There are over 100 revenue sources that support the General Fund such as different types of taxes, licenses and permit fees and charges for using different county facilities.

- About 90% of total revenues come from two sources - property taxes paid by County residential and commercial property owners and income taxes paid by County residents. Both vital revenue sources have entered a moderate growth stage.

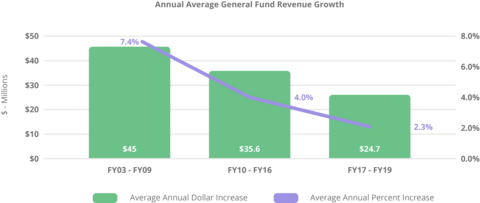

Revenue growth remains moderate

Actual revenue growth has been slowing from an annual average of above 7% over a decade ago to less than 3% on average in the past three years. The moderate growth is attributed to many factors that are expected to continue in near future. These include a relatively slow job growth which matched the national trend during the recovery from the last economic recession, changing demographics with faster growth in the aging and lower income population and a potential economic recession or downturn.

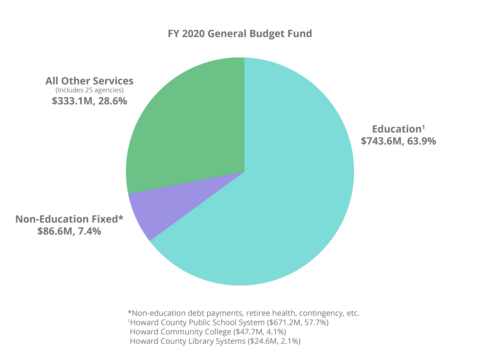

FY 2020 General Fund Expenditures

Education (Public Schools, Library, Community College) remains the County’s Number 1 priority

- County funding to education accounts for about 2/3 of the total budget, with funding for HCPSS exceeding half of all General Fund spending.

- County funding to education is five times its funding to public safety.

- Howard County ranks 3rd among Maryland’s 24 counties for local spending per pupil. County spending per student totaled $10,603, 41% higher than the State average of $7,507.

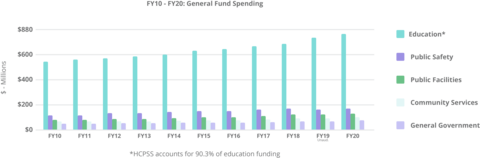

Key Spending Drivers

- Cost of providing the same level of services continues to grow, driven by employee benefits & long-term liabilities (e.g. debt payments for infrastructure projects, pension and retiree health benefits, etc.).

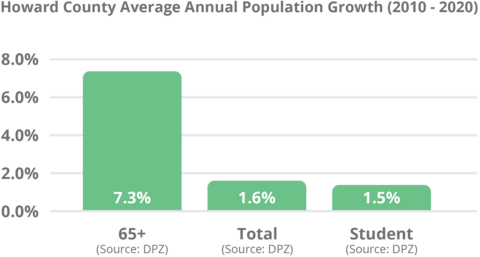

- Population growth results in increasing and competing demands for all kinds of services:

- Total population growth has been averaging 1.6% annually.

- Student enrollment growth has been averaging 1.5% annually.

- 65+ population growth has been averaging 7.3% annually.

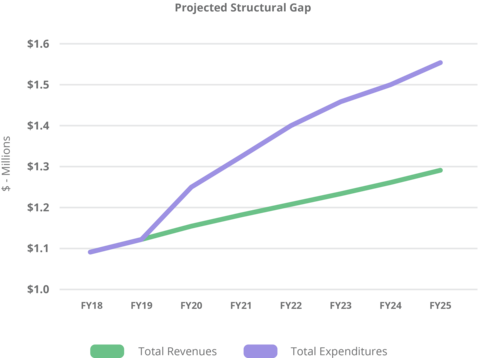

General Fund Long-Term Outlook (FY 2020 to FY 2025)

Long Term Outlook FY 2020 to FY 2025

- The Fiscal 2020 Spending Affordability Advisory Committee (SAAC) report states that "there is a significant and growing gap between revenues and spending requests" and the gap or shortfall in revenues needed to cover spending needs "will likely reach $275 million by FY2025 without corrective actions."

- This structural gap is attributable to:

- Expenditure growth (driven by service costs and rising service needs) continues to significantly outpace revenue growth, which has averaged less than 3% in recent years.

- Impacts stemming from a potential economic recession and the Adequate Public Facilities Ordinance (APFO) legislation, which included a four-year moratorium for new development until adequate infrastructure or public services are in place. The legislation is expected to result in foregone revenues of $138 million in six years and $1.2 billion in 20 years, per a consultant study.

Available Options to Address Fiscal Challenges:

The SAAC report states that “Without changes to revenues or expenditures, current patterns of spending are unsustainable in the long-term."

Expenditures: Continue efforts to innovate and find long-term and permanent savings.

- Transform business practices and seek innovative solutions to generate permanent savings and productivity.

- Prioritize and balance all service needs to provide the full range of services demanded by residents.

Revenues: Explore new revenue sources while balancing tax burden.

The County recently increased the fire tax and trash fee, imposed a new ambulance fee (the revenues are restricted for specific uses), and increased the School Surcharge (restricted for school capital projects).

The County will continue to explore revenue options while balancing overall tax burdens.

| Jurisdictions | Real Property Tax | Income Tax | Recordation Tax | Transfer Tax |

|---|---|---|---|---|

| Anne Arundel | $0.9350 | 2.81% | $3.50 | 1.00% |

| Baltimore City | $2.2500 | 3.20% | $5.00 | 1.50% |

| Baltimore County | $1.1000 | 3.20% | $2.50 | 1.50% |

| Harford | $1.0420 | 3.06% | $3.30 | 1.00% |

| Howard | $1.2500 | 3.20% | $2.50 | 1.00% |

| Montgomery | $0.9786 | 3.20% | $3.45 | 0.25% - 6.00% |

| Prince George's | $1.0000 | 3.20% | $2.75 | 1.40% |

| State Average | $1.0332 | 3.02% | $4.05 | 0.76% |

*Transfer tax revenues are restricted to funding capital projects.

Restricted Funds are legally restricted for spending on special purposes such as providing water and sewer, fire, and trash collection services. Click on the links to see detailed descriptions for each of the funds:

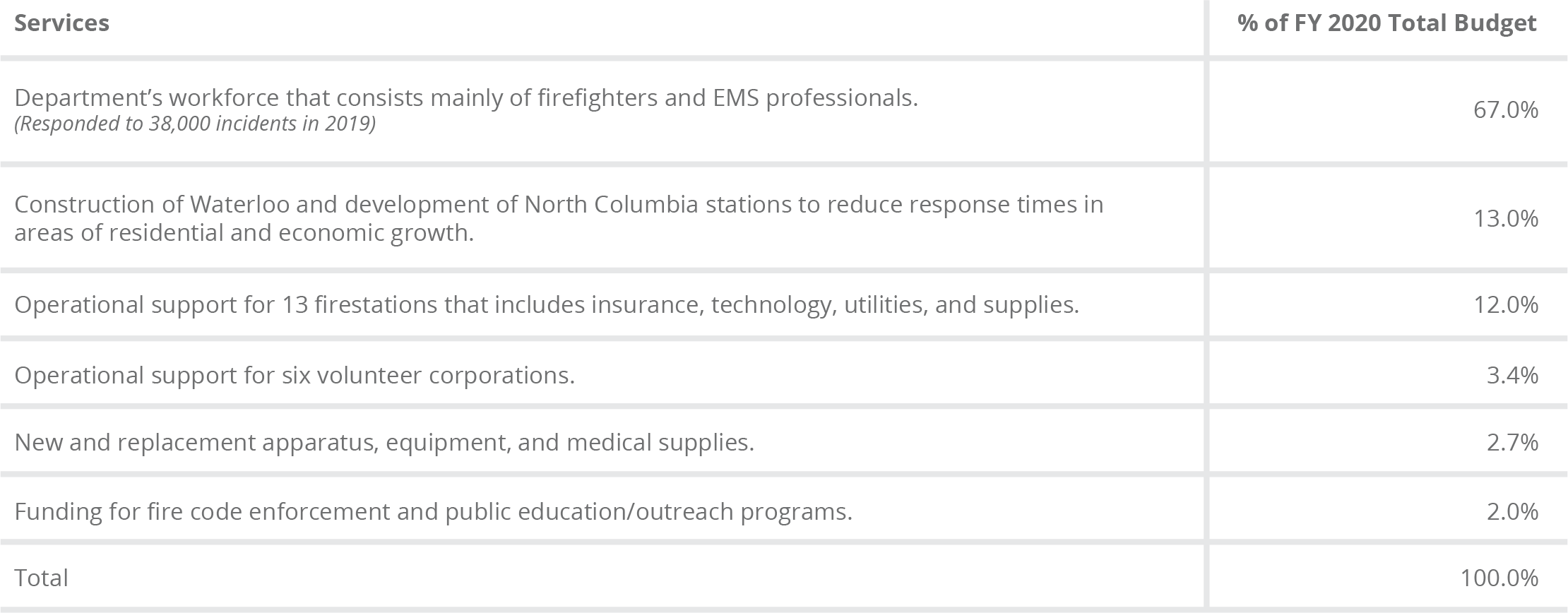

Fire and Rescue Tax Fund

This restricted fund is primarily supported by the Fire Tax which is currently 23.60 cents per $100 of assessed value. A new Emergency Medical Services (EMS) Transport Fee passed in FY 2020 also provides revenue to this fund.

Water and Sewer Operating Fund

This fund is restricted for the operation and maintenance of the County’s water and reclaimed water sewer systems. The County does not own or operate any water supply facilities but instead purchases 95% of its potable water from Baltimore City and 5% from the Washington Suburban Sanitary Commission. The money to fund services comes primarily from water and sewer user charges imposed on customers in the Metropolitan District. This fund is self-sustaining and does not depend upon general tax dollars.

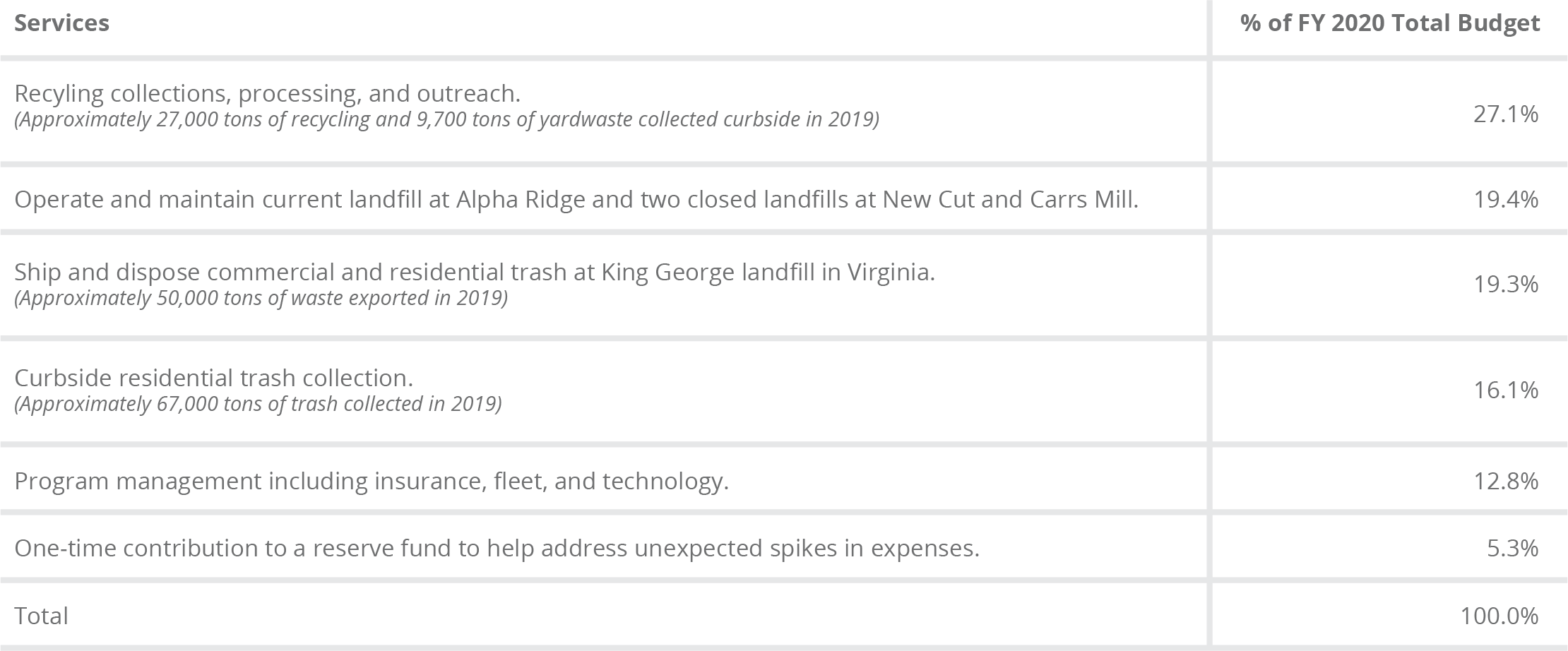

Environmental Services Fund

Fees collected from users for trash/recycling collection and disposal are dedicated to this restricted fund to offset the cost of waste collection, disposal and recycling expenses including the operation of the County’s landfill. The current annual fee is $310 for trash and recycling collection and $325 for trash, recycling and yard waste collections.

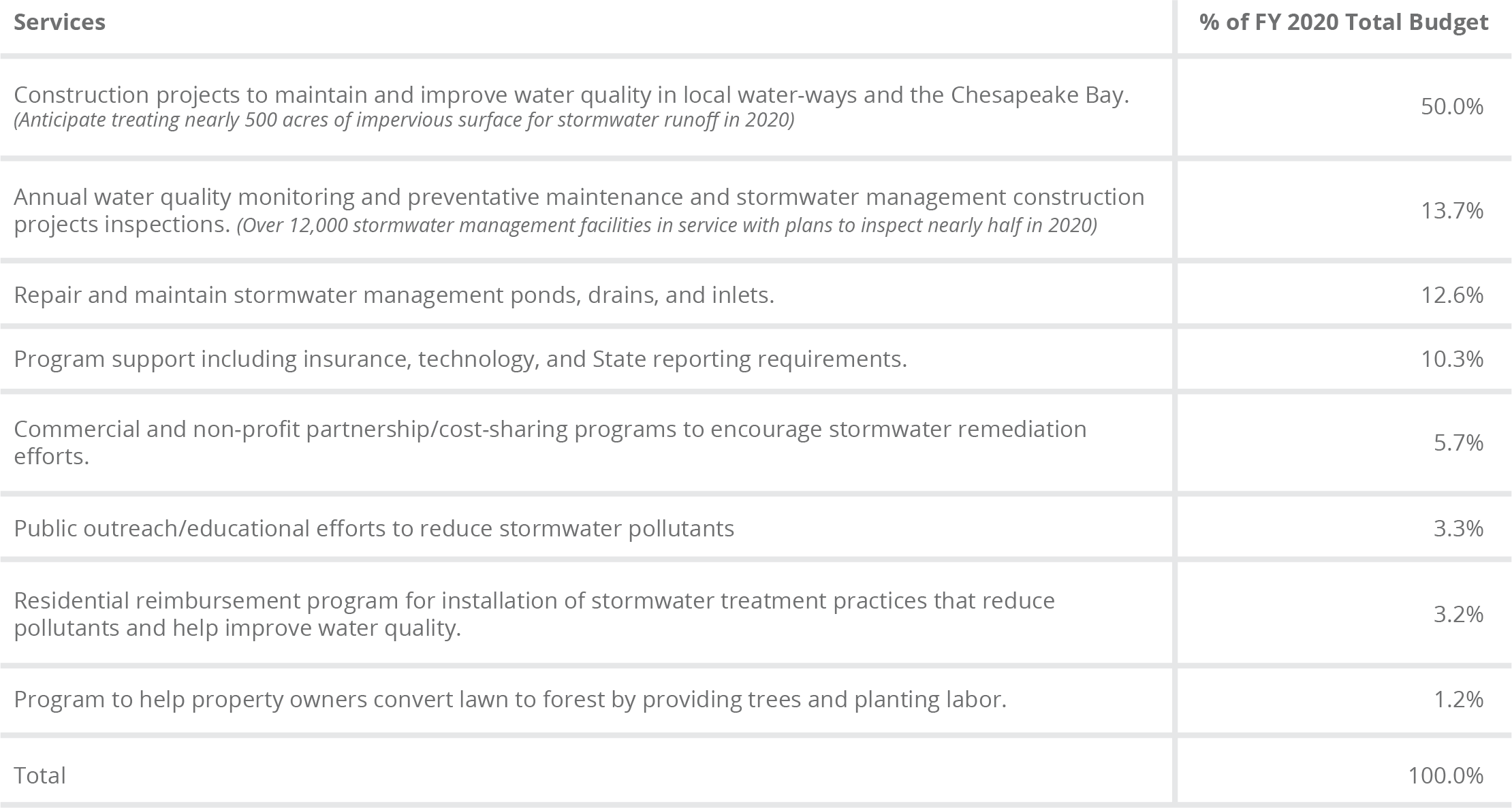

Watershed Protection and Restoration

This restricted fund is designed to provide a sustainable dedicated revenue source from the annual stormwater remediation fees to fund the maintenance, operations and improvement of local stormwater management system. The fund is self-sustaining and does not depend upon general tax dollars. The current annual fees are as follows: condominium and townhomes at $15 per unit; single family residential ($45 for lots up to 0.25 acres and $90 for lots above); and commercial at $15 per 500 sf of impervious surface.

Recreation & Parks Fund

This restricted fund allows the County to provide access to parks and recreational programs primarily funded by fees collected from users.

Forest Conservation Fund

This restricted fund allows the County to provide forest mitigation and reforestation inspections in compliance with local and state requirements and revenues from developers are used to cover expenses.

Community Renewal Program Fund

This restricted fund was created to provide affordable housing opportunities for residents of all income levels. Funding primarily comes from 12.5% of the local transfer tax collections.

Agricultural Preservation Fund

This restricted fund supports the Agricultural Land Preservation and Promotion Program, which is designed to preserve the open character and agricultural use of land in the County. Funding mainly comes from 25% of the local transfer tax collections.

Speed Enforcement Fund

This restricted fund allows the County to implement a speed enforcement program to increase public safety on county roadways. Revenues are derived from fines paid by motor vehicle operators exceeding the posted speed limits. Funds more than those needed to operate the program can be used for other public safety uses in the capital and operating budget.

Shared Septic Fund

This restricted fund pays for the operation and maintenance of small private shared septic systems located in the western part of the County. The systems are installed by developers but maintained by the County. Households pay for the operation and maintenance costs.

Internal Service Funds

These restricted funds are used to account for goods and services furnished by certain County agencies to other County agencies primarily on a cost reimbursement basis. Includes the Employee Benefits, Risk Management, Fleet; and Technology funds. The anticipated expenses are budgeted directly in all applicable county departments and funds and the aggregate revenues and expenses are presented in these funds.

Commercial Paper Bond Anticipation Note

This program enables the county to borrow for the capital construction program at the lowest interest rates instead of using general funds. Included in this fund are all costs and revenues of the program. Revenue in excess of cost is returned to the general fund as investment income.

TIF Districts Fund

This restricted fund has been created to account for the real property tax increment received from owners of property located in Annapolis Junction Town Center, Downtown Columbia and Laurel Park Special Taxing Districts. Deposits to this fund are used to pay debt service on the tax increment financing bonds issued to fund public infrastructure improvements.

Savage Special Tax District Fund

This restricted fund accounts for special taxing district real property taxes received from owners of property located in the Savage Towne Centre Increment Financing District.

Program Revenue Fund

Programs included in this restricted fund are supported by the revenues collected for the services provided. Accounts have been established for use by various county agencies.

Grants Fund

Used to account for resources provided to the County by another government (or other source) and usually designated for a specific purpose.

Trust and Agency Multifarious Funds

This restricted fund allows adequate accounting and control of escrow accounts, while at the same time permitting resident contributions for special purposes. Accounts have been established for use by various county agencies.

Water/Sewer Special Benefits Charges and Capital Projects Fund

This restricted fund collects monies to finance water and sewer projects, including debt service.

Recreation Special Facilities Fund

This restricted fund accounts for the operation & management of the Timbers at Troy golf course.

Broadband Initiative Funds

The County has three restricted Broadband funds (County Government; Non-County Government; and Private Sector) used to manage the delivery of broadband services. Revenues generated come from negotiated fees and charges for services provided.