About

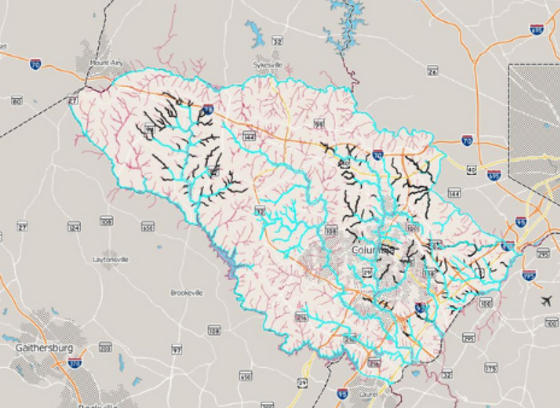

As a public service, Howard County Government provides residents with floodplain information upon request based on the Federal Emergency Management Agency’s (FEMA’s) effective Flood Insurance Rate Map (FIRM).

Map Information Service

Visit the County’s Digital Flood Insurance Rate Map website to view mapping and information on:

- Flood zone and base flood elevation and depth

- Location and elevation of a property or building structure relative to the Special Flood Hazard Area (SFHA)

- Information on historic FIRMs

- Information on County-regulated floodplains

FEMA’s 2013 Flood Insurance Study (FIS) for the FIRMs can be found here:

The old, superceded version of the FIS, along with paper FIRMs are available for viewing at the Bureau of Environmental Services and can also be found at local Howard County libraries.

Current Elevation Certificates in the County can be found below.

Flood damage is not covered by homeowner's insurance policies, however, you can protect your home,

business, and belongings with flood insurance from the National Flood Insurance Program (NFIP). You can

buy flood insurance no matter what your flood risk, but don't wait for the next flood to buy insurance

protection. There is usually a 30 day waiting period before the NFIP coverage takes effect.

If a building is within a Special Flood Hazard Area (SFHA), a lender is required by law to require a loan recipient to purchase a flood insurance policy on the building. Therefore, if your building is in a SFHA and you have a mortgage loan from a federally related financial assistance program or from a lender that is regulated, supervised, or insured by federal agencies, you would be required to purchase flood insurance. SFHAs are considered to be high-risk Flood Zones A and AE. Federal law does not require flood insurance purchases in moderate-risk Shaded Zone X or low-risk Flood Zone X areas, however, lenders and/or insurance agents could still require you to purchase flood insurance based on their own risk assessment and judgment.

If your building or property is outside of FEMA’s SFHA or outside of the County-regulated 100-year floodplain, you still have the option to purchase flood insurance if you feel it is warranted. If you have additional questions related to flood insurance, contact your homeowner’s insurance agent or consult the National Flood Insurance Program (NFIP) at 1-888-379-9531.

Your property may be located within the FEMA floodplain or the County-regulated 100-year floodplain delineated for smaller drainage areas than those delineated by FEMA for its SFHA. If this is the case, County development restrictions would apply to your property.

Howard County does not permit development in the floodplain. Before you make any improvements (build

on, alter, re-grade, or fill in) on your property, please check with the Howard County Department of

Inspections, Licenses, and Permits (DILP) and the Department of Planning and Zoning (DPZ) located at 3430 Courthouse Drive, Ellicott City, MD 21043 to determine if you are subject to building restrictions, if you see illegal development in the floodplain, or if the changes you make will alter water drainage and adversely affect other properties.

For additional information on County development regulations related to the 100‑year floodplain, please contact the Department of Planning and Zoning.

In November 2013, the Federal Emergency Management Agency (FEMA) made effective new Flood Insurance Rate Maps (FIRM) for Howard County, which replaced the 1986 FIRMs. FIRMs are used by the National Flood Insurance Program (NFIP) to determine if flood insurance is mandatory on any given property and now the 2013 FIRMs more accurately represent flooding risks change over time due to changes in land use, weather events and other factors. The 2013 FIRMs were then digitized and are referred to as Digital Flood Insurance Rate Maps (DFIRM). Note that the 2013 FIRM and DFIRM have the same information; the DFIRM is simply the 2013 FIRM in digital format.

How will these changes affect me?

As a result of changes in the DFIRM:

1. Some homes will be included in the Special Flood Hazard Area (SFHA), i.e., the FEMA regulated 100-year flood plain for the first time.

- If your home is in the floodplain (SFHA zones “A” or “AE”) based on the new maps and you have a mortgage from a federally-regulated lender you will, most likely, be required to carry flood insurance after the new maps go into effect.

2. Some homes will be removed from the mapped floodplain (SFHA).

- If your home is currently in the FEMA floodplain but, under the new DFIRM, has been taken out of the floodplain, flood insurance will no longer be required by FEMA.

- However, if another part of your property other than your home remains in the floodplain, your mortgage holder may still elect to require you to carry flood insurance.

- You may, at your own discretion, maintain flood insurance, but at the lower rates offered to homes outside the SFHA.

3. Some homes will remain in the mapped floodplain (SFHA)

- If your home was in the previous flood plain, and is also shown on the new map or DFIRM as still in the floodplain (SFHA, zone “A” or “AE”), and has a mortgage from a federally-regulated lender, then by federal law your lender must require you to carry flood insurance.

Regardless of the FEMA flood designation for your home, if you feel your home is at risk of flooding, you may still purchase flood insurance.

County staff is available to assist residents one-on-one with floodplain and drainage questions through the Bureau of Environmental Services, 9801 Broken Land Parkway, Columbia, MD 21046. Contact Environmental Services at DoIFlood@HowardCountyMD.gov or call 410-313-6444 during normal business hours.

LOMRs are generally based on better topographic, modeling, or physical structures that affect the hydrologic or hydraulic characteristics of a flooding source and thus result in the modification of the effective Base Flood Elevations (BFEs), the Special Flood Hazard Area (the 100-year floodplain), and sometimes the Flood Insurance Study (FIS) report. The LOMR officially revises the Flood Insurance Rate Map (FIRM).

Currently, there are four effective LOMRs for Howard County. Three LOMRs are effective, and one is still being processed by FEMA.

Note Regarding Tiber-Hudson Branch and Tiber-Hudson Tributary LOMR Case 21-03-0871P: Processing of the LOMR Case 21-03-0871P for the Tiber-Hudson Branch and Tiber-Hudson Tributary has been cancelled by the Federal Emergency Management Agency (FEMA). This LOMR was cancelled because FEMA determined that the graphical representation of the floodplains, which were approved by FEMA, were not accurately depicted. FEMA has initiated a new LOMR (Case # 22-03-0019P) for the same reach of the Tiber-Hudson Branch and Tiber-Hudson Tributary to correct the graphical representations for the floodplain boundaries. It is important to note that the modeling results and the water surface elevations did not change between the two LOMRs (Case #21-03-0871P and Case #22-03-0019P); only the graphical representation of the floodplain boundaries changed. The computed water surface elevations, which are used to determine if the purchase flood insurance is required, did not change between the two LOMRs.